The Fashion Industry’s Circularity Challenge: From Waste to Opportunity

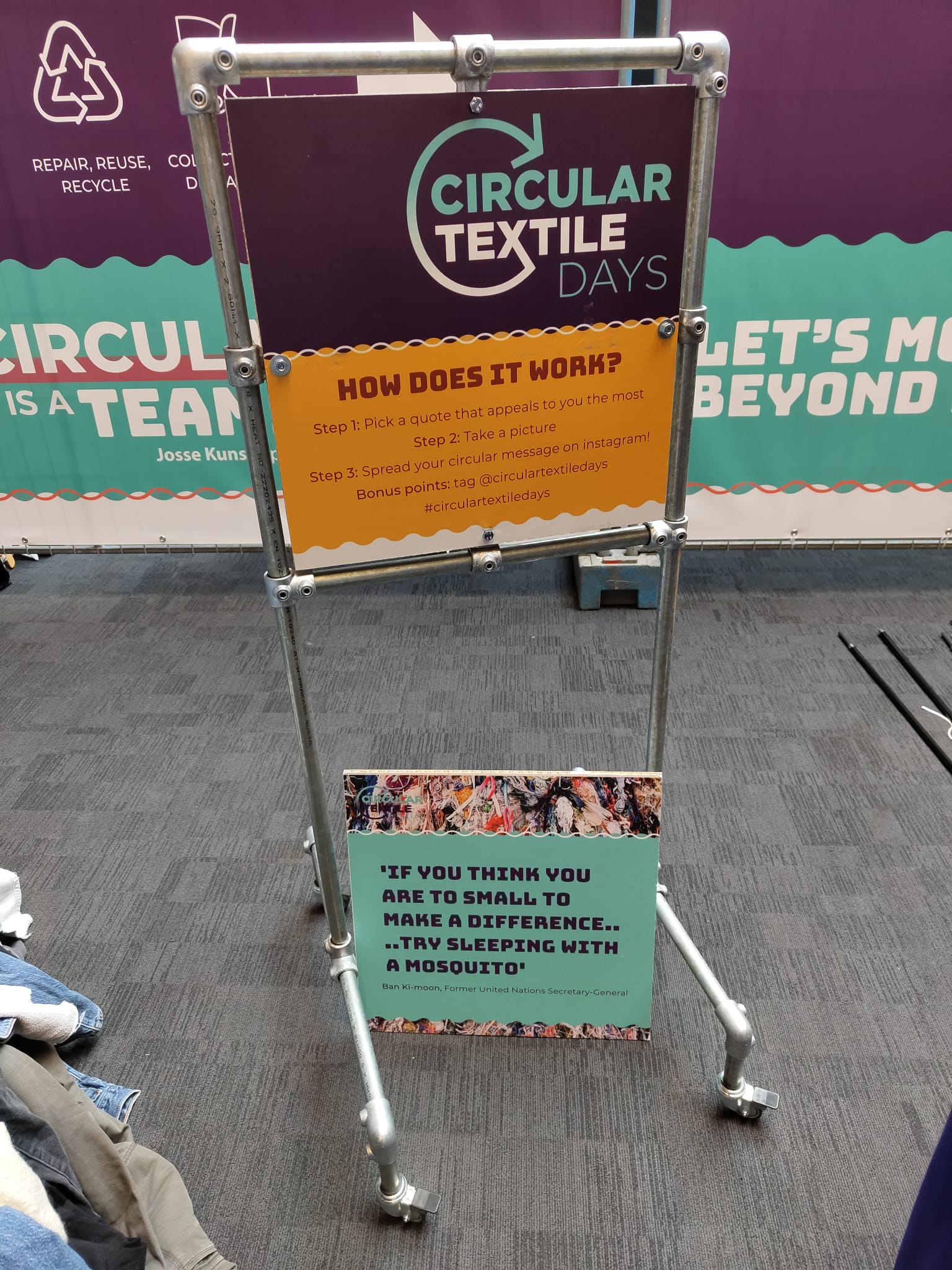

Two weeks ago, I attended two key events that explored the future of fashion: BIR’s “The Circularity Challenge” in Brussels and the Textile Circular Days in the Netherlands. Both events highlighted the complex state of the textile industry, where increasing volumes of waste meet an underdeveloped recycling market. But despite these challenges, a clear opportunity is emerging for the second-hand fashion sector.

A Market Struggling to Adapt

Let me take you into the world of textile collectors and recyclers. Their daily challenge is clear: more clothes are being collected than ever before, but fewer of these garments are of sufficient quality for resale or recycling. Fast fashion is largely to blame, producing cheaper, low-quality clothing that wears out quickly and is difficult to recycle.

At these events, collectors voiced their frustration: the post-consumer recycled fiber-to-fiber market is almost non-existent, and they point fingers at fashion companies, consumer habits, and government inaction. Currently, only about 20-30% of collected items are resellable for local stores, with strict quality checks. For those selling in bulk across the globe, this figure can rise to 60-70%, depending on the grading of the clothes. Lower-grade clothing is often sent to African and Asian countries. Some nations have loose policies regarding textile imports, while others, like Ghana and Pakistan, have built efficient networks of sorters, recyclers, and resellers, reducing landfill waste to as low as 1-2% of incoming textiles.

The Vicious Cycle of Fashion Waste

Here’s where the problem becomes a cycle. Consumers have no incentive to buy clothing made from recycled fibers, especially when the price is higher than fast fashion alternatives. This lack of demand makes fashion brands unwilling to invest in recycled fibers, limiting the market's growth. Today, less than 1% of textiles are made from recycled materials. Without demand, there’s little motivation to scale recycling plants.

Many recyclers are calling on governments to enforce legislation requiring a percentage of recycled fibers in new clothing—perhaps just 5% to start. Such a mandate could create the demand needed to kickstart the market, generate revenue, and build recycling infrastructure.

However, as we learned at the Textile Circular Days, recycling is not a perfect solution. While it’s certainly better than producing new clothes, recycling is an energy-intensive process. Second-hand fashion, on the other hand, extends the life of garments with minimal environmental impact. The more we embrace re-wearing, the longer we can delay the need for recycling.

The Shift to Second-Hand

The answer might already be in motion. The second-hand clothing market is booming and is projected to surpass traditional fashion by 2028. In fact, by that time, 50% of second-hand sales will take place online, opening up a vast digital marketplace for consumers to find pre-loved fashion. This shift is a major opportunity for both consumers and businesses to rethink how we buy, sell, and value clothes.

But even the most durable clothing has its limits. Over time, wear and tear from stains, holes, and overwashing reduce quality. While repair and upcycling can help, they are not often cost-effective solutions. This brings us to a critical juncture: where can the industry go from here?

A Call to Action

There’s an urgent need to embrace circularity in all its forms. As we move forward, the focus should be on:

Using long-lasting, quality garments that can be worn and repaired for years.

Supporting second-hand markets as the most sustainable option for extending garment life.

Encouraging innovation in recycling, but recognizing its limits.

The future of fashion is not only about what we wear, but how we consume. As the second-hand market continues to grow and evolve, consumers will play a vital role in driving demand for sustainable options, whether through buying pre-owned or supporting brands that use recycled materials.

In the end, the choice is ours: do we keep feeding the cycle of waste, or do we choose fashion that’s built to last?

Sources:

Statista. "Global secondhand apparel market size from 2023 to 2028."

ThredUp 2023 Report on Secondhand Fashion Market.

McKinsey & Company. "Fashion’s New Must-Have: Sustainable Sourcing at Scale."

BIR (Bureau of International Recycling) Conference Reports.

Textile Circular Days Event Notes and Industry Briefs.

The Fashion Industry’s Circularity Challenge: From Waste to Opportunity

Two weeks ago, I attended two key events that explored the future of fashion: BIR’s “The Circularity Challenge” in Brussels and the Textile Circular Days in the Netherlands. Both events highlighted the complex state of the textile industry, where increasing volumes of waste meet an underdeveloped recycling market. But despite these challenges, a clear opportunity is emerging for the second-hand fashion sector.

A Market Struggling to Adapt

Let me take you into the world of textile collectors and recyclers. Their daily challenge is clear: more clothes are being collected than ever before, but fewer of these garments are of sufficient quality for resale or recycling. Fast fashion is largely to blame, producing cheaper, low-quality clothing that wears out quickly and is difficult to recycle.

At these events, collectors voiced their frustration: the post-consumer recycled fiber-to-fiber market is almost non-existent, and they point fingers at fashion companies, consumer habits, and government inaction. Currently, only about 20-30% of collected items are resellable for local stores, with strict quality checks. For those selling in bulk across the globe, this figure can rise to 60-70%, depending on the grading of the clothes. Lower-grade clothing is often sent to African and Asian countries. Some nations have loose policies regarding textile imports, while others, like Ghana and Pakistan, have built efficient networks of sorters, recyclers, and resellers, reducing landfill waste to as low as 1-2% of incoming textiles.

The Vicious Cycle of Fashion Waste

Here’s where the problem becomes a cycle. Consumers have no incentive to buy clothing made from recycled fibers, especially when the price is higher than fast fashion alternatives. This lack of demand makes fashion brands unwilling to invest in recycled fibers, limiting the market's growth. Today, less than 1% of textiles are made from recycled materials. Without demand, there’s little motivation to scale recycling plants.

Many recyclers are calling on governments to enforce legislation requiring a percentage of recycled fibers in new clothing—perhaps just 5% to start. Such a mandate could create the demand needed to kickstart the market, generate revenue, and build recycling infrastructure.

However, as we learned at the Textile Circular Days, recycling is not a perfect solution. While it’s certainly better than producing new clothes, recycling is an energy-intensive process. Second-hand fashion, on the other hand, extends the life of garments with minimal environmental impact. The more we embrace re-wearing, the longer we can delay the need for recycling.

The Shift to Second-Hand

The answer might already be in motion. The second-hand clothing market is booming and is projected to surpass traditional fashion by 2028. In fact, by that time, 50% of second-hand sales will take place online, opening up a vast digital marketplace for consumers to find pre-loved fashion. This shift is a major opportunity for both consumers and businesses to rethink how we buy, sell, and value clothes.

But even the most durable clothing has its limits. Over time, wear and tear from stains, holes, and overwashing reduce quality. While repair and upcycling can help, they are not often cost-effective solutions. This brings us to a critical juncture: where can the industry go from here?

A Call to Action

There’s an urgent need to embrace circularity in all its forms. As we move forward, the focus should be on:

Using long-lasting, quality garments that can be worn and repaired for years.

Supporting second-hand markets as the most sustainable option for extending garment life.

Encouraging innovation in recycling, but recognizing its limits.

The future of fashion is not only about what we wear, but how we consume. As the second-hand market continues to grow and evolve, consumers will play a vital role in driving demand for sustainable options, whether through buying pre-owned or supporting brands that use recycled materials.

In the end, the choice is ours: do we keep feeding the cycle of waste, or do we choose fashion that’s built to last?

Sources:

Statista. "Global secondhand apparel market size from 2023 to 2028."

ThredUp 2023 Report on Secondhand Fashion Market.

McKinsey & Company. "Fashion’s New Must-Have: Sustainable Sourcing at Scale."

BIR (Bureau of International Recycling) Conference Reports.

Textile Circular Days Event Notes and Industry Briefs.

The Fashion Industry’s Circularity Challenge: From Waste to Opportunity

Two weeks ago, I attended two key events that explored the future of fashion: BIR’s “The Circularity Challenge” in Brussels and the Textile Circular Days in the Netherlands. Both events highlighted the complex state of the textile industry, where increasing volumes of waste meet an underdeveloped recycling market. But despite these challenges, a clear opportunity is emerging for the second-hand fashion sector.

A Market Struggling to Adapt

Let me take you into the world of textile collectors and recyclers. Their daily challenge is clear: more clothes are being collected than ever before, but fewer of these garments are of sufficient quality for resale or recycling. Fast fashion is largely to blame, producing cheaper, low-quality clothing that wears out quickly and is difficult to recycle.

At these events, collectors voiced their frustration: the post-consumer recycled fiber-to-fiber market is almost non-existent, and they point fingers at fashion companies, consumer habits, and government inaction. Currently, only about 20-30% of collected items are resellable for local stores, with strict quality checks. For those selling in bulk across the globe, this figure can rise to 60-70%, depending on the grading of the clothes. Lower-grade clothing is often sent to African and Asian countries. Some nations have loose policies regarding textile imports, while others, like Ghana and Pakistan, have built efficient networks of sorters, recyclers, and resellers, reducing landfill waste to as low as 1-2% of incoming textiles.

The Vicious Cycle of Fashion Waste

Here’s where the problem becomes a cycle. Consumers have no incentive to buy clothing made from recycled fibers, especially when the price is higher than fast fashion alternatives. This lack of demand makes fashion brands unwilling to invest in recycled fibers, limiting the market's growth. Today, less than 1% of textiles are made from recycled materials. Without demand, there’s little motivation to scale recycling plants.

Many recyclers are calling on governments to enforce legislation requiring a percentage of recycled fibers in new clothing—perhaps just 5% to start. Such a mandate could create the demand needed to kickstart the market, generate revenue, and build recycling infrastructure.

However, as we learned at the Textile Circular Days, recycling is not a perfect solution. While it’s certainly better than producing new clothes, recycling is an energy-intensive process. Second-hand fashion, on the other hand, extends the life of garments with minimal environmental impact. The more we embrace re-wearing, the longer we can delay the need for recycling.

The Shift to Second-Hand

The answer might already be in motion. The second-hand clothing market is booming and is projected to surpass traditional fashion by 2028. In fact, by that time, 50% of second-hand sales will take place online, opening up a vast digital marketplace for consumers to find pre-loved fashion. This shift is a major opportunity for both consumers and businesses to rethink how we buy, sell, and value clothes.

But even the most durable clothing has its limits. Over time, wear and tear from stains, holes, and overwashing reduce quality. While repair and upcycling can help, they are not often cost-effective solutions. This brings us to a critical juncture: where can the industry go from here?

A Call to Action

There’s an urgent need to embrace circularity in all its forms. As we move forward, the focus should be on:

Using long-lasting, quality garments that can be worn and repaired for years.

Supporting second-hand markets as the most sustainable option for extending garment life.

Encouraging innovation in recycling, but recognizing its limits.

The future of fashion is not only about what we wear, but how we consume. As the second-hand market continues to grow and evolve, consumers will play a vital role in driving demand for sustainable options, whether through buying pre-owned or supporting brands that use recycled materials.

In the end, the choice is ours: do we keep feeding the cycle of waste, or do we choose fashion that’s built to last?

Sources:

Statista. "Global secondhand apparel market size from 2023 to 2028."

ThredUp 2023 Report on Secondhand Fashion Market.

McKinsey & Company. "Fashion’s New Must-Have: Sustainable Sourcing at Scale."

BIR (Bureau of International Recycling) Conference Reports.

Textile Circular Days Event Notes and Industry Briefs.

The Fashion Industry’s Circularity Challenge: From Waste to Opportunity

Two weeks ago, I attended two key events that explored the future of fashion: BIR’s “The Circularity Challenge” in Brussels and the Textile Circular Days in the Netherlands. Both events highlighted the complex state of the textile industry, where increasing volumes of waste meet an underdeveloped recycling market. But despite these challenges, a clear opportunity is emerging for the second-hand fashion sector.

A Market Struggling to Adapt

Let me take you into the world of textile collectors and recyclers. Their daily challenge is clear: more clothes are being collected than ever before, but fewer of these garments are of sufficient quality for resale or recycling. Fast fashion is largely to blame, producing cheaper, low-quality clothing that wears out quickly and is difficult to recycle.

At these events, collectors voiced their frustration: the post-consumer recycled fiber-to-fiber market is almost non-existent, and they point fingers at fashion companies, consumer habits, and government inaction. Currently, only about 20-30% of collected items are resellable for local stores, with strict quality checks. For those selling in bulk across the globe, this figure can rise to 60-70%, depending on the grading of the clothes. Lower-grade clothing is often sent to African and Asian countries. Some nations have loose policies regarding textile imports, while others, like Ghana and Pakistan, have built efficient networks of sorters, recyclers, and resellers, reducing landfill waste to as low as 1-2% of incoming textiles.

The Vicious Cycle of Fashion Waste

Here’s where the problem becomes a cycle. Consumers have no incentive to buy clothing made from recycled fibers, especially when the price is higher than fast fashion alternatives. This lack of demand makes fashion brands unwilling to invest in recycled fibers, limiting the market's growth. Today, less than 1% of textiles are made from recycled materials. Without demand, there’s little motivation to scale recycling plants.

Many recyclers are calling on governments to enforce legislation requiring a percentage of recycled fibers in new clothing—perhaps just 5% to start. Such a mandate could create the demand needed to kickstart the market, generate revenue, and build recycling infrastructure.

However, as we learned at the Textile Circular Days, recycling is not a perfect solution. While it’s certainly better than producing new clothes, recycling is an energy-intensive process. Second-hand fashion, on the other hand, extends the life of garments with minimal environmental impact. The more we embrace re-wearing, the longer we can delay the need for recycling.

The Shift to Second-Hand

The answer might already be in motion. The second-hand clothing market is booming and is projected to surpass traditional fashion by 2028. In fact, by that time, 50% of second-hand sales will take place online, opening up a vast digital marketplace for consumers to find pre-loved fashion. This shift is a major opportunity for both consumers and businesses to rethink how we buy, sell, and value clothes.

But even the most durable clothing has its limits. Over time, wear and tear from stains, holes, and overwashing reduce quality. While repair and upcycling can help, they are not often cost-effective solutions. This brings us to a critical juncture: where can the industry go from here?

A Call to Action

There’s an urgent need to embrace circularity in all its forms. As we move forward, the focus should be on:

Using long-lasting, quality garments that can be worn and repaired for years.

Supporting second-hand markets as the most sustainable option for extending garment life.

Encouraging innovation in recycling, but recognizing its limits.

The future of fashion is not only about what we wear, but how we consume. As the second-hand market continues to grow and evolve, consumers will play a vital role in driving demand for sustainable options, whether through buying pre-owned or supporting brands that use recycled materials.

In the end, the choice is ours: do we keep feeding the cycle of waste, or do we choose fashion that’s built to last?

Sources:

Statista. "Global secondhand apparel market size from 2023 to 2028."

ThredUp 2023 Report on Secondhand Fashion Market.

McKinsey & Company. "Fashion’s New Must-Have: Sustainable Sourcing at Scale."

BIR (Bureau of International Recycling) Conference Reports.

Textile Circular Days Event Notes and Industry Briefs.